In the previous blog, we learnt what information we can store in the customer card, customer credit groups, how to setup regular and temporary credit limits, create risk scores and credit limit adjustments. So basically, we learnt how to create credit limits and do adjustments.

What to do with customer credit limits?

So once the limits are established, we wish to have credit control over transactions. This can be achieved by credit management holds.

Credit Management Holds

- Order holds based on not one but up to nine credit rules, depending on organisational needs, Risk assessments can be used as filters in the rules.

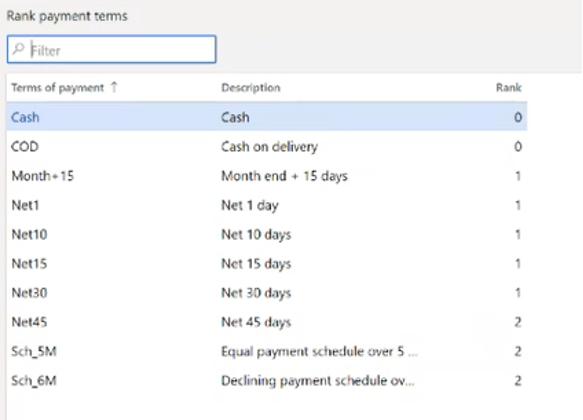

- Blocking rule is payment terms, so if the payment terms are more favorable to customer, say it is ranked 2 then, you can create a rule to block the sales order to the customer.

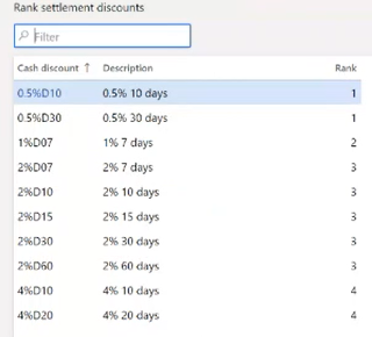

2. Rank settlement discounts

If the customer is offered more discounts, the rule can be created to block the sales order. Or if say customer has no discount, and you put him on a discount or say higher discount, then also the system can put it on hold.

3. Setup days overdue blocking rules – you can have blocking rules based on number of days overdue.

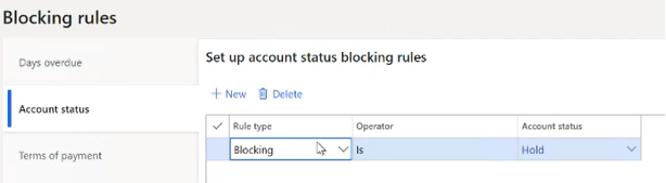

4. Blocking rule based on account status being on hold.

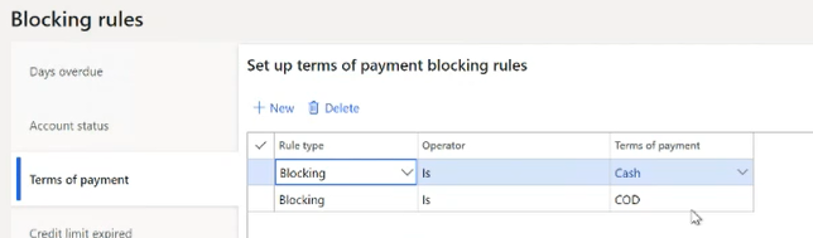

5. Blocking rule based on terms of payment

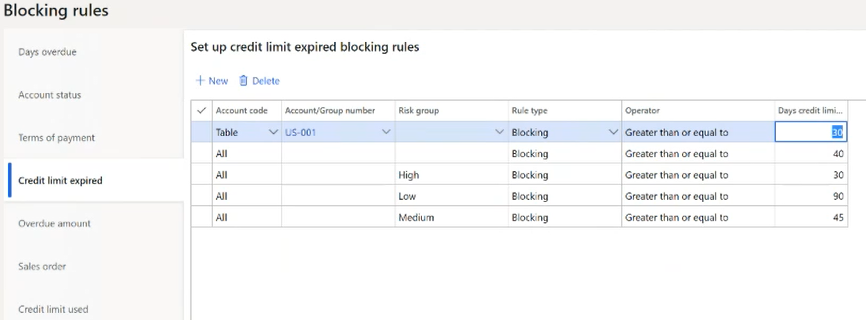

6. Blocking rule based on expiry of credit limit, here we have to define what expiration means, say for example a customer whose credit limit is expired for 30 days or more can be blocked. Similarly, you can fix expiration based on risk group of the customer.

7. Blocking rule based on overdue amount is based on how much a customer is overdue and how much of the credit limit they have used.

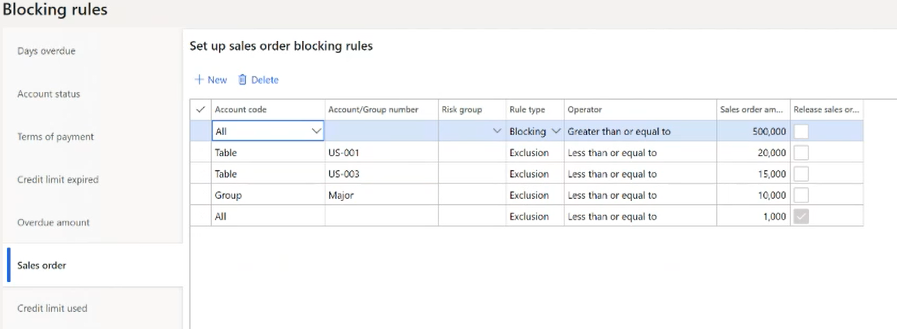

8. Sales order blocking rules – in this type of rule we have both blocking as well as exclusion rules. Let’s look at the first one, blocking all orders greater than 500,000. Next, we can exclude specific customer account or group from all the blocking rules, say if for all customers sales order value less than or equal to 1,000, here we do not wish to have any blocking rules for small order sales, so we exclude it.

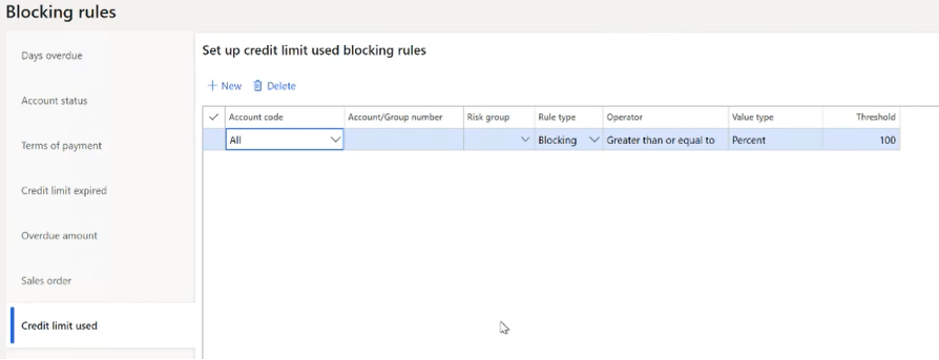

9. Credit limit blocking rules, here you can set up a threshold for credit limit utilised.

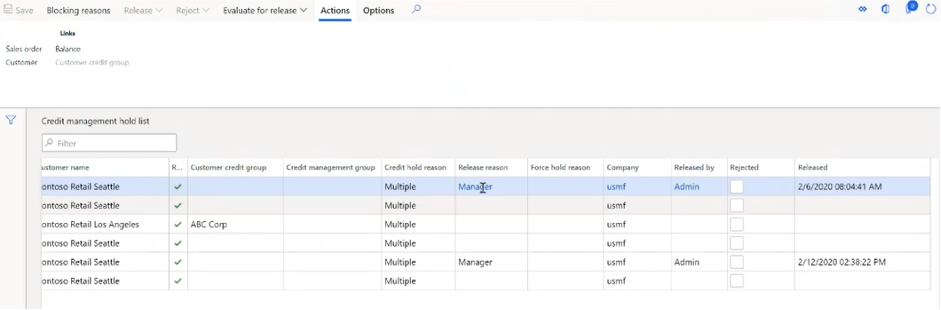

- Global list page for managing and releasing orders on hold

You can check the reasons and release/reject it.

You can run evaluate for release periodically, and the system will check if all the blocking rules have been cleared and release the blocked documents. You don’t have to release manually; the system will release for selected lines or for all in batch.

Hierarchy of credit limits

- System will first check “Customer Group”, then

- Each individual customer,

- Check for Temporary credit limits including insurance.

- Then regular credit limit.

Author – Rajiv Sethi

Comments (0)