xDynamics 365 Finance continues to lead in bringing in intelligence and automation to users. Wave 1 2021 Release for Dynamics 365 Finance, is another step in this direction. This release brings the intelligent cash flow offering to public preview with automation based on predictive results. Users experience out-of-the-box machine learning for their financial operations, including viewing when customers are predicted to pay, forecasting what the budget should be, and viewing forecasted cash positions based on actual accounts payables, accounts receivables, project transactions, and predicted outcomes.

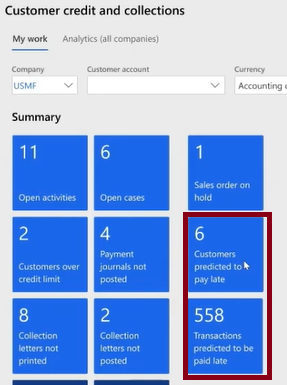

Automation based on predictions around collections enhances a business’s strategy to influence positive incoming cash flow even further.

This blog lists features that are released/planned for Dynamics 365 Finance 2021 wave 1 release, from April through September 2021.

Core Financials

a. Advanced Bank Reconciliation statement end date and subsequent bank statement start date can be the same. This lets you set the end date of one statement to be the exact same point in time as the start of the next statement. This change gives you more flexibility for making the statements that are imported into Dynamics 365 Finance match the time frame that your bank might use to generate daily statements.

b. Vendor collaboration bank changes. This feature lets vendors view the bank accounts that they’ve set up for the business they conduct with your organization. They can also disable existing bank accounts and add new ones. A new inquiry will let accounts payable users review updated bank information. After the new accounts have been reviewed and the primary payment method has been manually updated, the records can be marked as reviewed so they’re removed from the list.

c. Cash flow forecasting – project integration. Projects that use a forecast model for cost and revenue estimates can be included in the cash flow forecasting capability in cash and bank management. Once the forecast model is selected in Cash flow forecast setup, the forecasted costs and revenues are included when viewing the Cash overview – current company workspace or the Cash overview – all companies workspace in cash and bank management. The project types and cost transaction types to include can be specified when you set up the cash flow forecast.

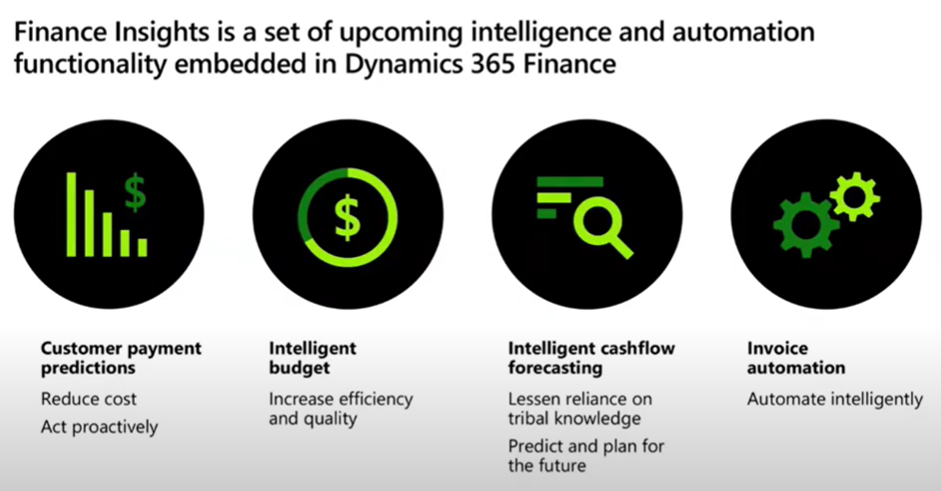

Finance Insights

AI is transforming finance fast, and Finance Insights from Microsoft D365 Finance Insights is transforming the way we introduce machine learning into the business. Predictive Finance insights provides configurable and extensible models to help you accurately and intelligently predict your company’s cash flow, predict when you will receive payment for outstanding receivables, and generate a budget proposal that can speed up your budgeting process. All these features are based on intelligent machine learning models. When these new capabilities are combined with automation in vendor payments and collections, they provide a rich and intelligent financial system that drives decision making and helps you respond effectively to current and anticipated business challenges.

Changes in Dynamics 365 Finance 2021 release wave 1, in Finance Insights:

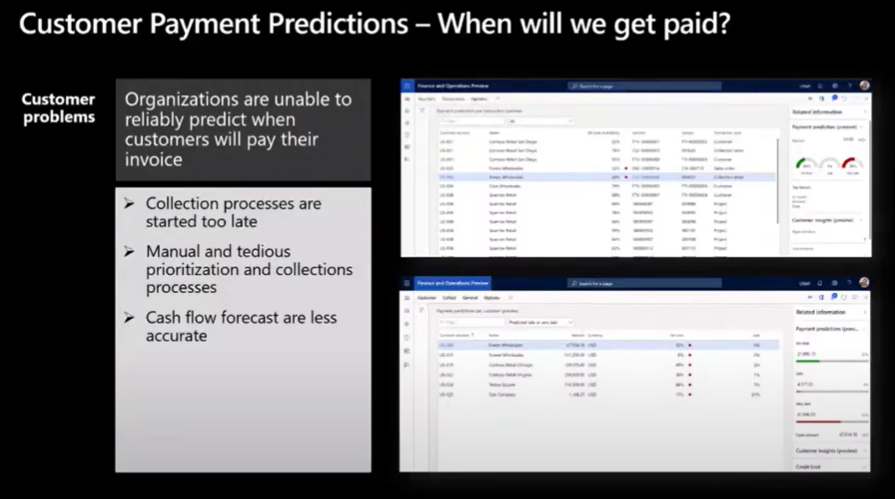

a. Customer payment predictions help answer and respond constructively to the following questions:

When will an invoice or sales order be paid?

Which customers will pay on time or late?

What invoices or orders will they pay?

Organisations currently are unable to predict with reliability, when they will be paid by the customers.

It leads to:

- Collections processes that start too late

- Manual and tedious prioritisation of collection processes

- Orders that are released to customers who may default on their payment

- Less accurate cash flow forecasts

Now, suppose, we could predict, when the customer would pay an invoice!

This is exactly what customer payment insights does, predicting when a customer invoice will be paid, thereby helping organisations create collection strategies, which in turn improves the probability of being paid on time.

Payment insights help by:

- Proactive collections using payment predictions

- Automated collections and communication strategy formulation

- Accurate cashflow forecasts by payment predictions

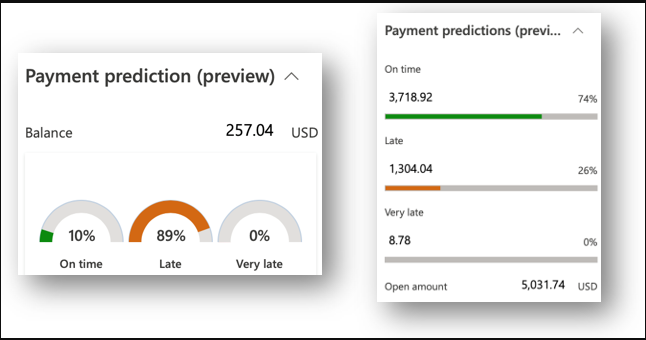

For each open invoice, Customer payment insights (Preview) predicts three payment probabilities:

- Probability of payment being made on time

- Probability of payment being made late

- Probability of payment being made very late

Customer payment insights, provides an aggregated view of expected payments.

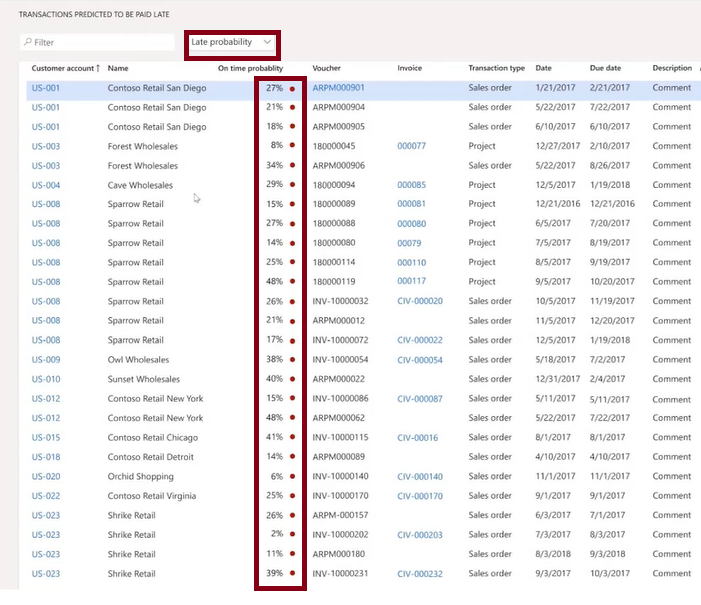

Also, each invoice is assigned a probability of payment on time. If the probability, of payment on time, is less than 50%, the invoices are tagged with a red circle to indicate these invoices require collections attention. You can provide a filter on probability of payments, as we have used “late probability” in the figure below.

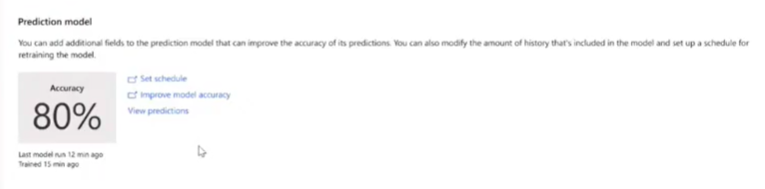

Customer Payment Insights also provides information as to how the prediction was arrived at, including:

- Top factors that influenced the predictions,

- The current state of business with the customer, and

- The detailed historical behaviour of the customer w.r.t. payment.

For most of the businesses, the collections process is a reactive activity; the collections process doesn’t commence until invoices are due.

Organisations no longer have to wait for the transactions to become due to start the collection process. The payment prediction capability determines whether proactive collections will improve the probability of being paid on time. Payment prediction also gives businesses the information needed to start early collection process and documentations.

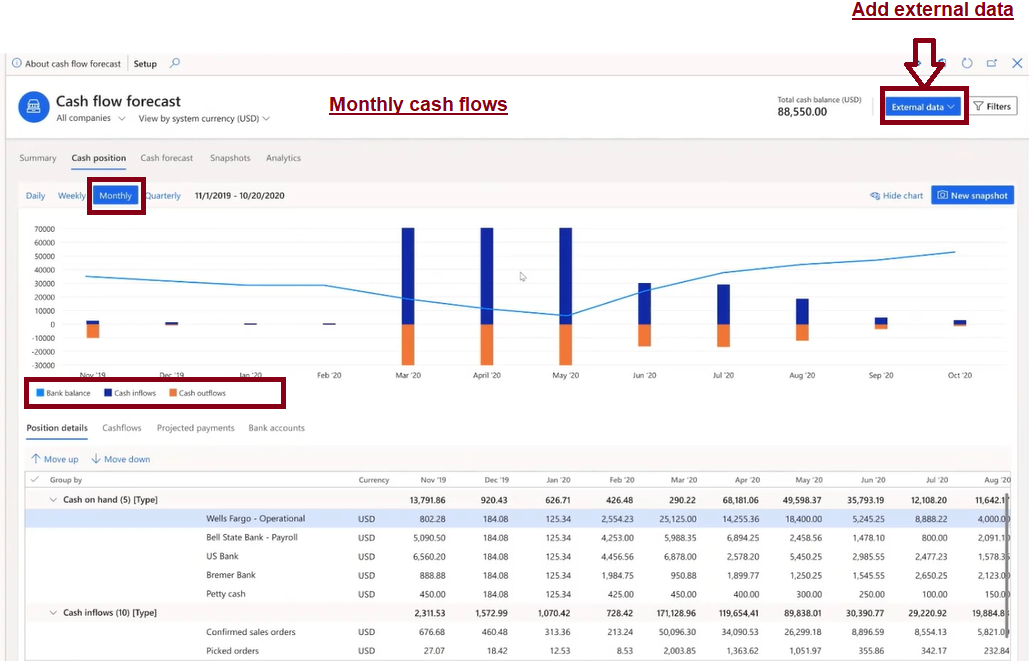

b. External data for cash flow forecasting

This feature lets you include external data in cash flow forecasting. It brings the capability to import external data from supporting systems into the cash flow engine to improve the accuracy of cash flow forecasting.

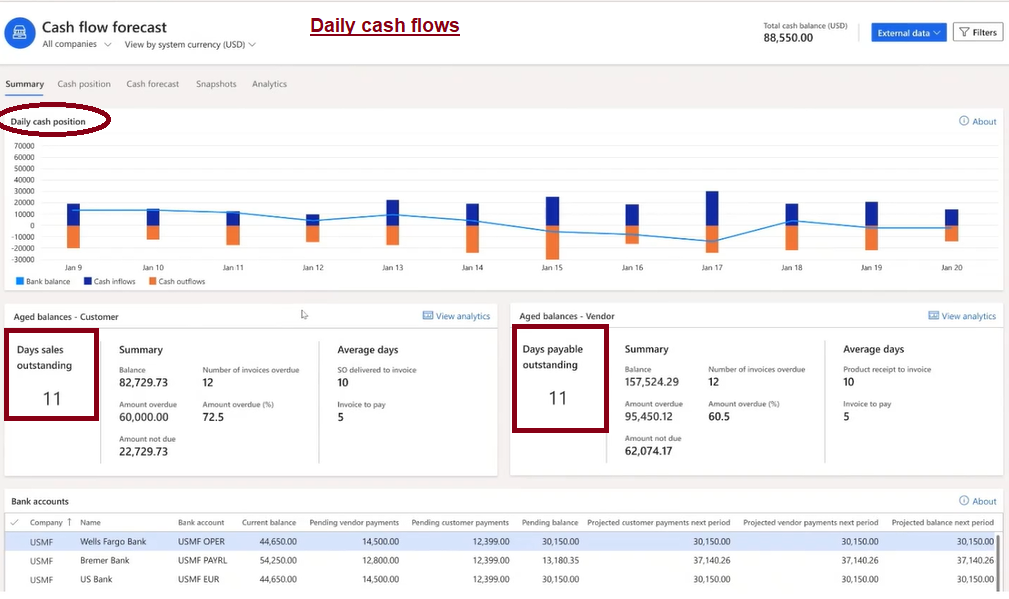

c. Forecast bank balance

How much cash will we have? It is a very tedious process to predict how much cash will be generated for payments on a given date. It is hard to measure the accuracy of cash flow forecasting.

The solution offered by AI:

- Enables intelligent and automated cashflow forecasting.

- Uses data from external sources and systems using data export and import framework.

- Intelligent cash positioning and forecasting based on customer payment predictions and AI builder’s time series forecasting.

- Saves cashflow forecasts and measure them against actual cashflows when they happen.

The forecast bank feature of Microsoft Dynamics 365 helps forecast and predict the bank balances on a given date, to meet commitments arising in future. It relies on information from customer payments history, and payment insights and vendor payments due, as well as recurring expenses and activities, predicts availability of funds at a given time in future.

d. Intelligent budget proposal:

- Reduce time and effort of budgeting process by letting AI perform these tasks.

- Consolidate years of historical data of your business to help you forecast and create budgets

- Intelligent budget proposal helps in creation of budgets, periodic forecasts through an automated, intelligent process.

The Intelligent budget proposal feature lets you create a draft budget automatically, but with a high degree of confidence from the use of historical data.

e. Treasurer workspace:

A treasurer’s job is to manage cash efficiently. Treasurers use multiple pages in the ERP product to conclude analysing information.

So, there was a need for having a workspace where all activities of treasury are consolidated — one workspace where treasurer’s need for information are met so that they can complete their entire day’s load. This tailored workspace helps in simplifying work and improves efficiency.

This workspace that includes all elements necessary for completing the analysis and activities that a treasurer needs to manage an organization’s cash.

For more details on Dynamics 365 2021 release wave 1 plan visit Microsoft Dynamics 365 2021 release wave 1 plan overview | Microsoft Docs

Comments (0)