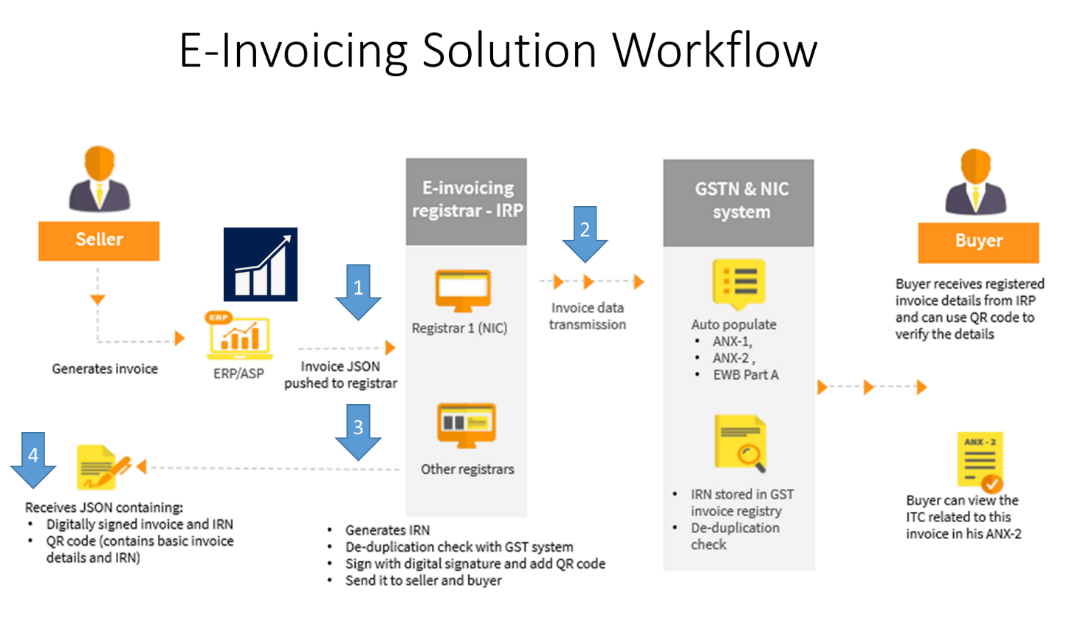

Organizations in India must be aware about the introduction of ‘E-invoicing’ mandate by GST Council, which requires businesses to report their B2B invoices to Govt. Businesses with a turnover of INR 100 Cr. and above are require to comply with E-invoicing effective 1st April 2020.

For companies using Microsoft Dynamics NAV, Alletec has developed a seamless integrated solution which provides Realtime API based IRP / GSP integration. Invoice data shall be sent to IRP & E-Invoice response shall be received. Based on this information the IRN number and QR code string is updated in Dynamics NAV. Printing of QR code on the invoice along with IRN number is available. We have also covered relevant validations prior posting for mandatory E-invoice information. The solution complies with the updated schema released by Government in October 2019.

Our solution is available with two options:

- Real-time on document posting for companies with low transactional volume.

- Bulk/ background E-Invoice generation for companies which have relatively high volume of transactions.

Our solution covers E-invoice generation for all applicable documents e.g. sales invoice, debit note, credit memo, and transfer for B2B, B2G, and Export Invoices. It also covers the invoices through eCommerce operators and Reverse charge transactions.

We understand the performance impact, such a solution can have on an ERP system and hence our solution has been designed in a way, that it does not impact the usual business operations and transactions in NAV.

Comments (0)